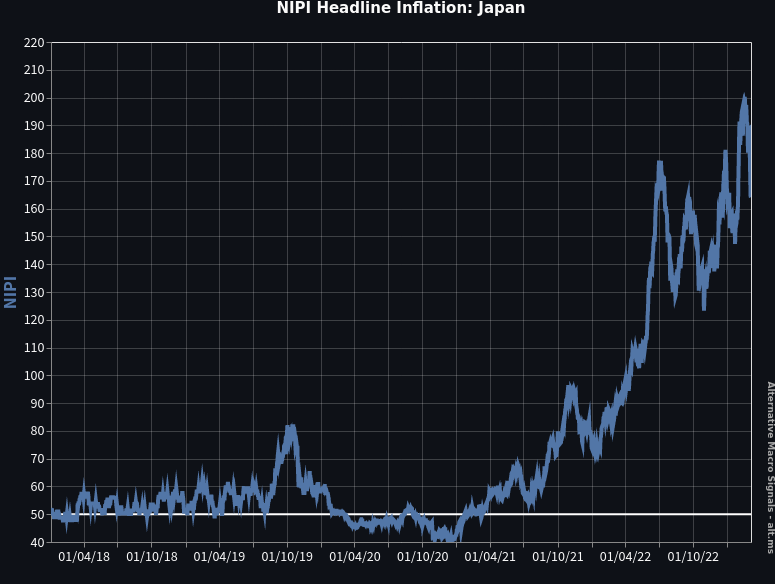

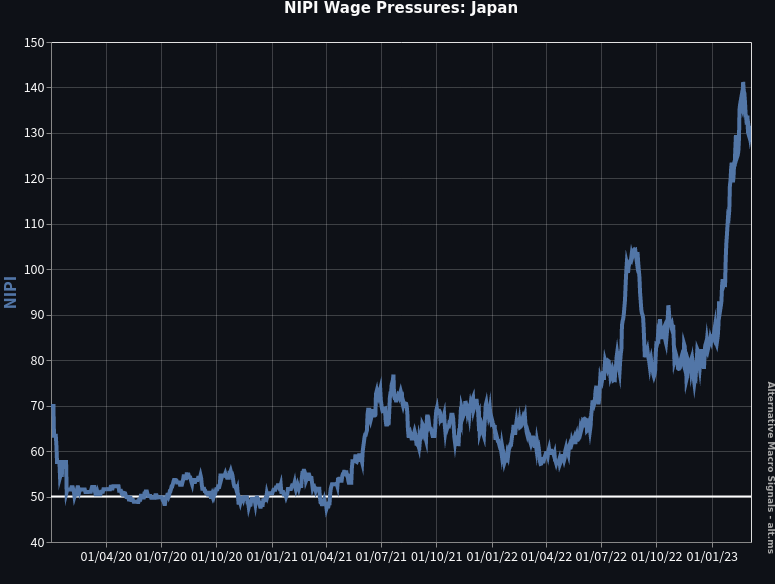

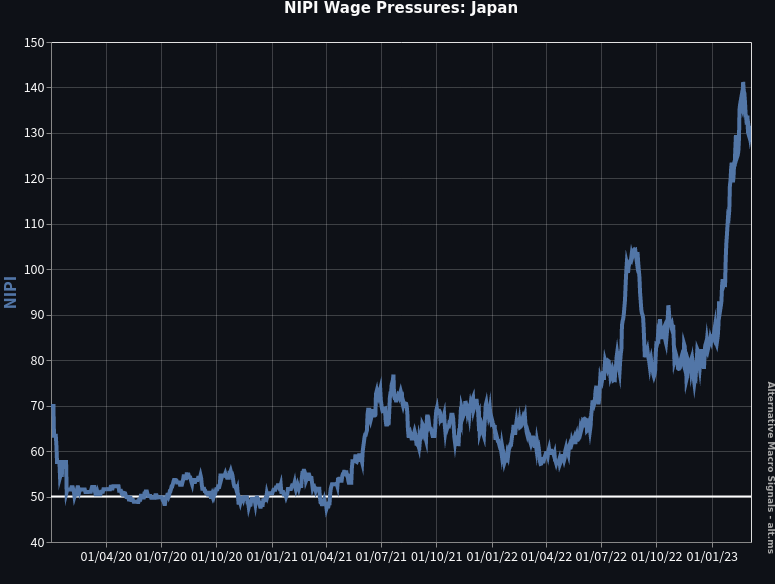

The Japan NIPI - our diffusion index measuring the balance of positive and negative inflation news through local news sources - has started to break out in the summer 2022. Since then, the positive news flow has been relentless.

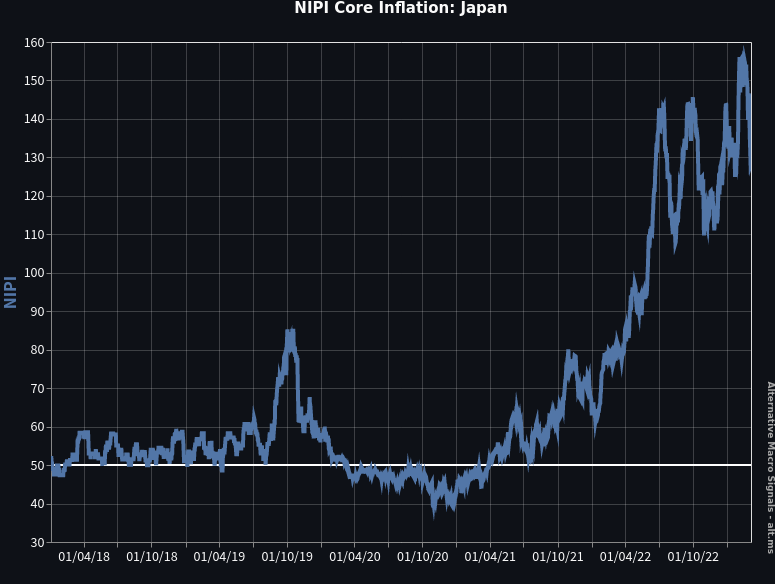

The picture is similar with both headline and core inflation pressures:

Note: a NIPI value of 50 is indicative of a balanced volume of positive and negative inflation news, a value above (below) 50 indicates positive (negative) inflationary pressures in the near-term.

The retailers and manufacturers which had announced broad-based price increases around the summer-autumn 2022 have been making similar announcements again in the last couple of months.

Besides, the NIPI-Wages which measures wage pressures through news articles has recently reached new highs.

The Japan case is unique among G7 economies. While inflation has remained elevated in most countries, high frequency indicators have been suggesting at least a stabilisation, if not some easing (which has yet to materialize in official CPIs). Not in Japan.

This raises an interesting question: is the Japan economy experiencing a significant inflation expectations reset?

Inflation is obviously a hot topic in North America and Europe, too. But in Japan, the break from several decades of deeply entrenched deflation could be particularly unsettling. In this regime change, there is more than a decent chance that inflation expectations will not magically reset from 0 to 2% but, rather, overshoot.