First in a set of analysis to characterize inflation dynamics post-COVID. We will look at inflation volatility, inflation persistence and inflation perception, through a range of metrics derived from official and alternative data, to assess what has changed and what hasn't.

First stop: inflation volatility. The data shows euro area inflation volatility remains puzzingly elevated at this point, when compared with the US.

In a 2022 Jackson Hole speech, ECB Board member Isabel Schnabel asked whether the "Great Moderation" economic era, the period of general economic stability which started in the mid-eighties, would be giving way to the "Great Volatility" era.

This is no rhetorical question. More volatile economic variables would challenge previous financial markets equilibriums, through increased "inflation premium" embedded in long-term interest rates. Indeed, more volatile inflation should be expected to increase the demand for inflation protection, even if average inflation is unchanged. More volatile economic variables would certainly have challenging implications for monetary policy, too.

Whether the "Great Moderation" has given way to the "Great Volatility" is going to be difficult to assess in real-time. Like any structural break, it is the kind of assessment that can only be done with a step back.

Almost two years after Isabel Schabel's speech, while the COVID-19 crisis is behind us, some structural disturbances have not receded. They strengthened, even, for instance: the unusual political and geopolitical tensions and the green transition. Those developments possibly durably increase economic uncertainties.

Inevitably, the evidence will be preliminary at this stage, but the point here is to identify the metrics to characterize inflation regime changes.

This first set of evidence looks at inflation volatility measures in the US and the euro area.

Inflation Volatility Measures

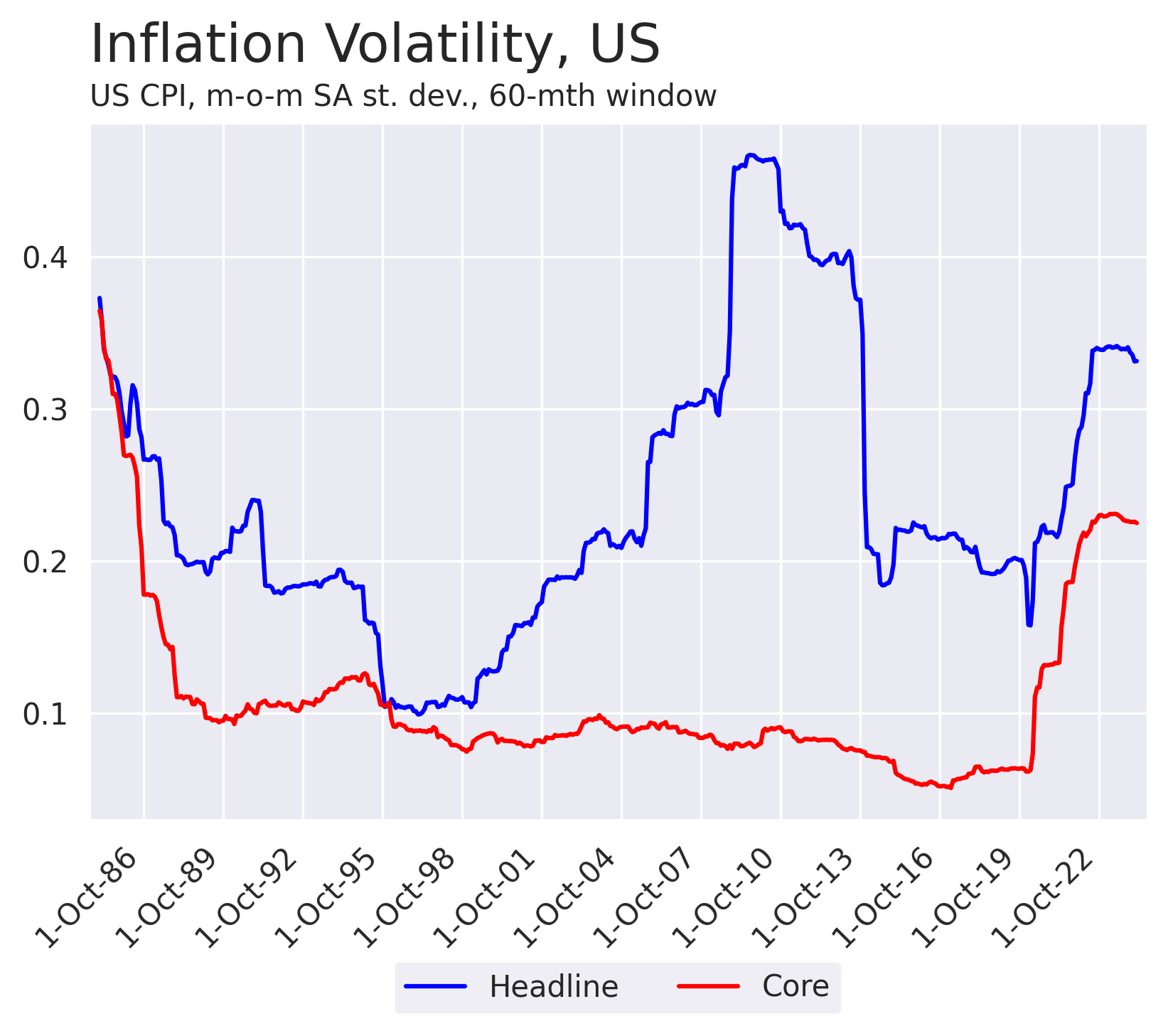

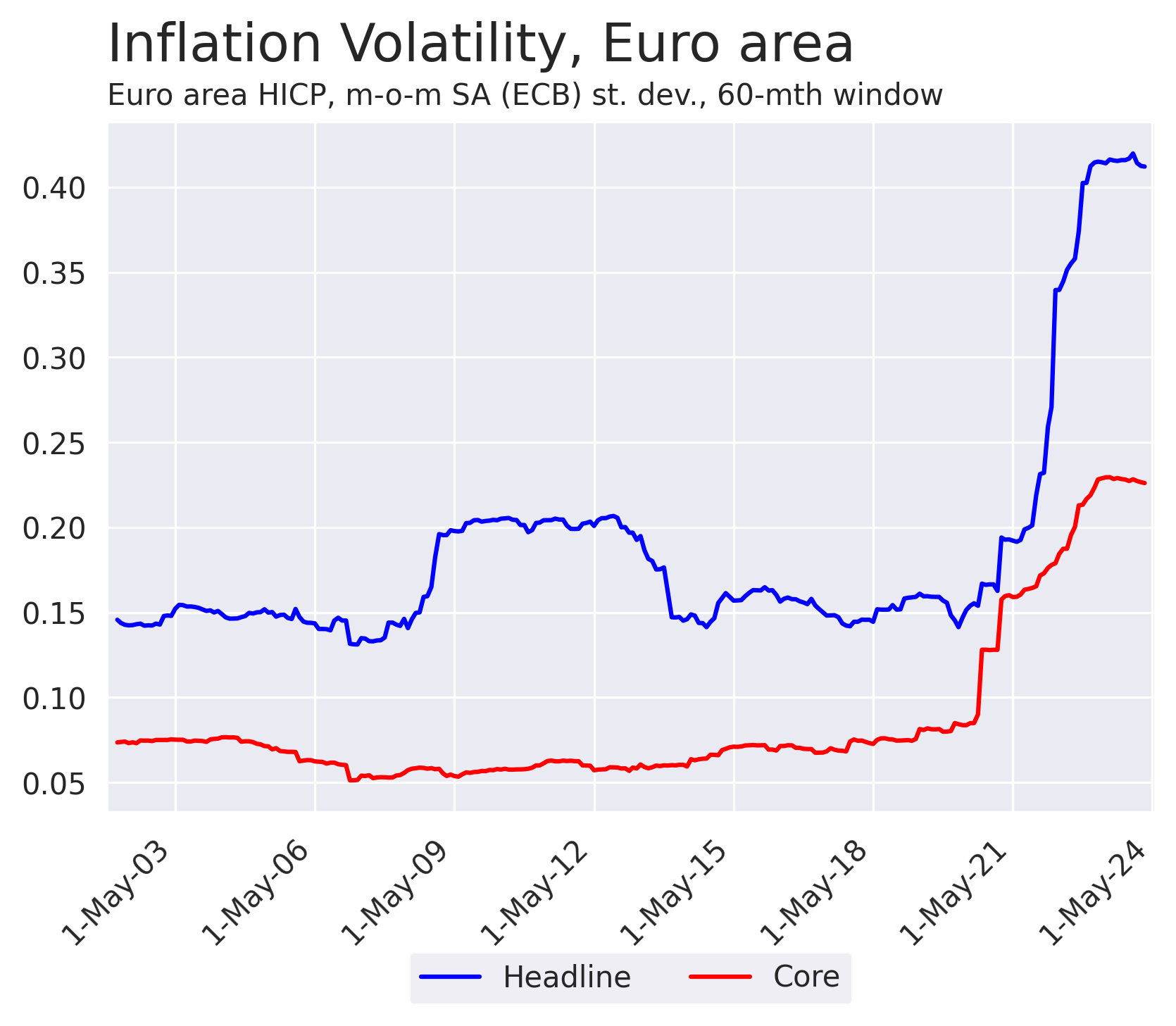

The below charts show inflation volatility in the US and the euro area, as measured by the standard deviation in month-on-month rates over rolling five-years period. The month-on-month rates are seasonally adjusted (by the US Bureau of Labor Statistics and the European Central Bank).

The most remarkable development is the core inflation volatility surge in both regions.

The data also suggests the volatility shock is even more unusual in the euro area, when compared to 2008 for instance. In Europe, the volatility surge since COVID is way larger than in 2008, across core and non-core inflation measures. In the US, "only" the core inflation dynamics is unusual (which is obviously already significant). Due to data availability issues, note that the sample is shorter in Europe, to be fair.

Of course, the 5-year window still has the whole COVID related period in the most recent observations.

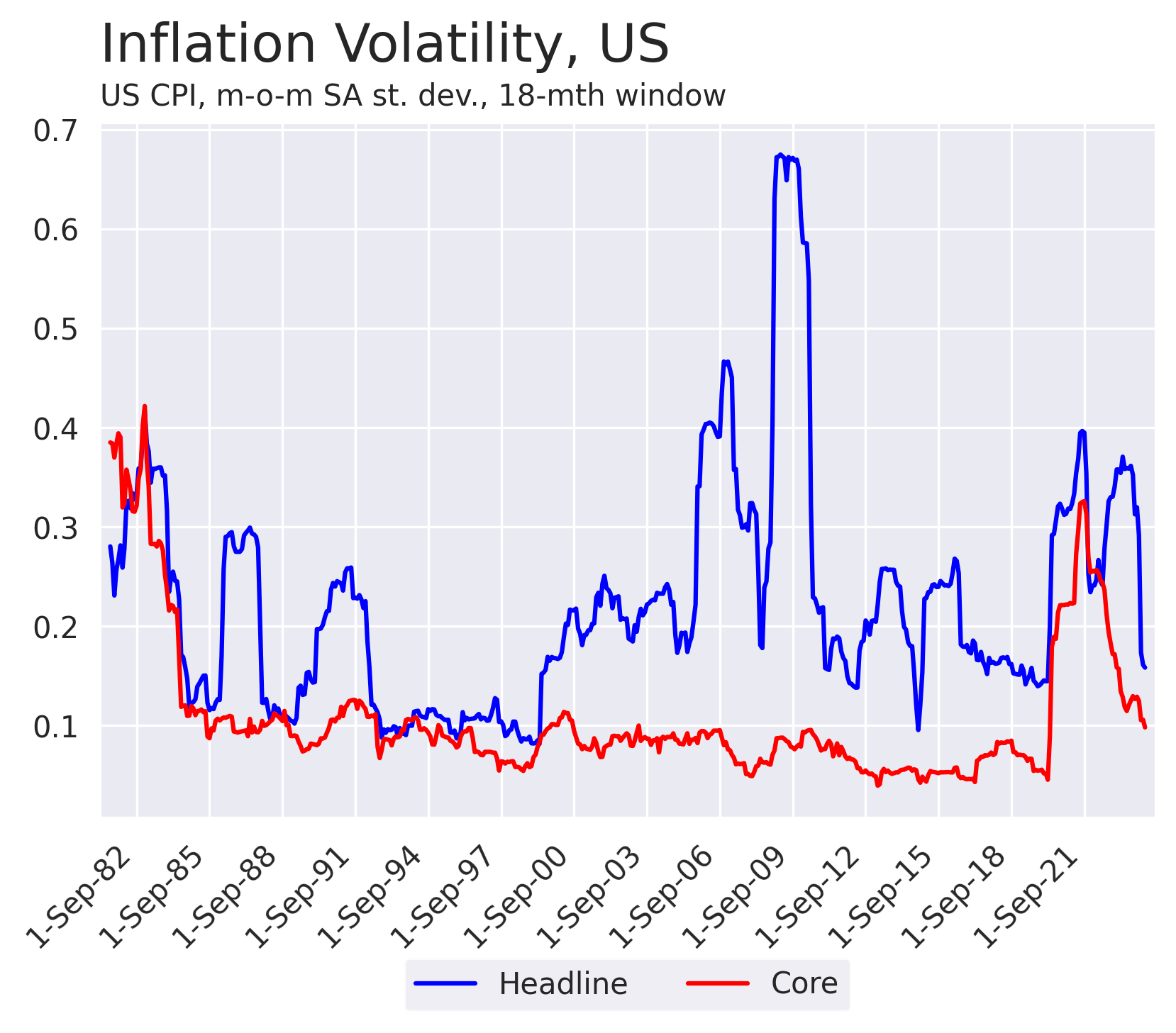

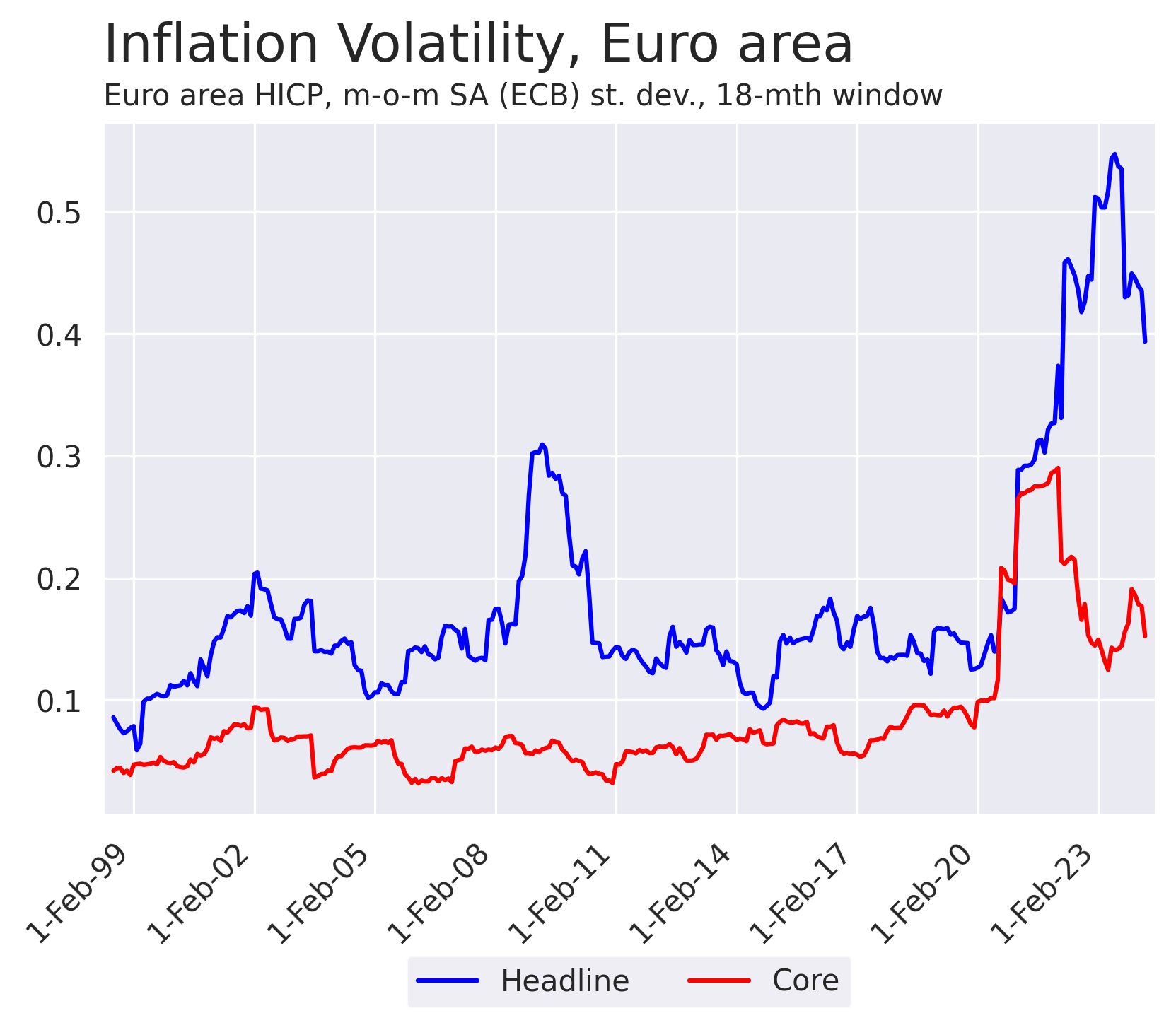

So let us look at the same calculation over a smaller time window, 18 months. It will be much noisier, but the last observation would cover the period from August 2022 until February 2024:

Recall these measures are inevitably more volatile and need to be taken with a pinch of salt.

In the US, the 18-month measures have tentatively normalized at this point, almost. Core inflation volatility is still at levels unseen in the previous couple of decades, but the improvement since peak-COVID is undeniable (and probably still ongoing).

In the euro area, rather strikingly, the 18-month volatility measures are far from having normalized at this point in time. Both core and headline inflation volatility seem to have stabilised at a high level by historical standards.

Unusually elevated euro area inflation volatility: possible explanations

How should we interpret this discrepancy between the US and the euro area?

One explanation would be simply that the disinflation process is less advanced in the euro area than in the US. If we look back, the whole inflation cycle in the euro area seems to have been lagging on the US by 3 to 6 months, so that could reasonably be part of the story.

The initial cycle delay may not be the whole story, though. The US Core inflation volatility has been just above the current levels (0.10-0.13 range) since Feb-2023, the big step down in US core volatility is more of a 2022 story... so the current euro area lag is well over the initial delay.

It could also be that some of the fundamental volatility drivers are still at play and are particularly acute in Europe. Consider, for instance, the continent's direct exposure to geopolitical tensions, through energy and agricultural supplies, or the specific challenges to its particularly integrated supply chains. We could mention the labour market functioning or more pro-active green transition: there are many candidate explanations which specific contribution will be difficult to quantify at this point.

Time will tell: it will be very interesting to see where month-to-month volatility will settle in both regions in the next six months or so.

One tentative conclusion can be drawn, though: in the euro area at least, the inflation normalization process is not done at this point; as far as inflation volatility is concerned, it has barely started.

In forthcoming analysis, we will add two sets of evidence to the inflation normalization question: inflation persistence and inflation perception through alternative data. Stay tuned!