Evidence that the post-lockdown inflation shock is both global and persistent are building-up

Global inflation pressures have been building up continuously since Q3 2020. Supply chain disruptions combined with brutal demand stop-and-go phases across regions have only had one effect on underlying inflationary pressure: pushing them up.

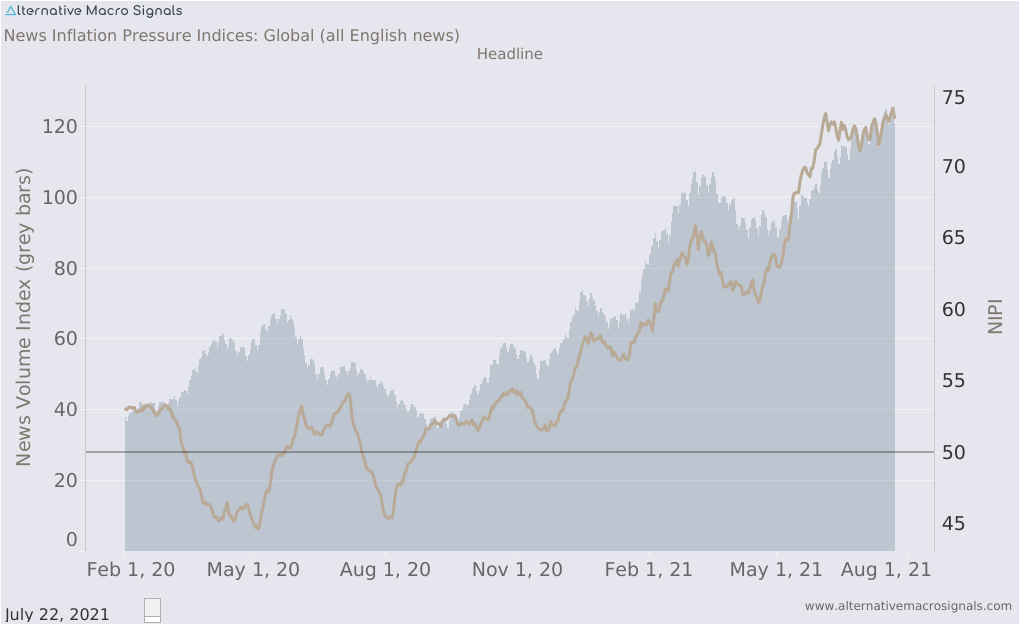

Global inflation in the news

Our News Inflation Pressure Indices (NIPI) track the Inflation newsflow across hundreds of thousands of news sources worldwide in six languages. They have given a lead over official inflation measures of up to a couple of months.

The NIPI shows the direction of the newsflow and the NVI (News Volume Index), the associated news volume.

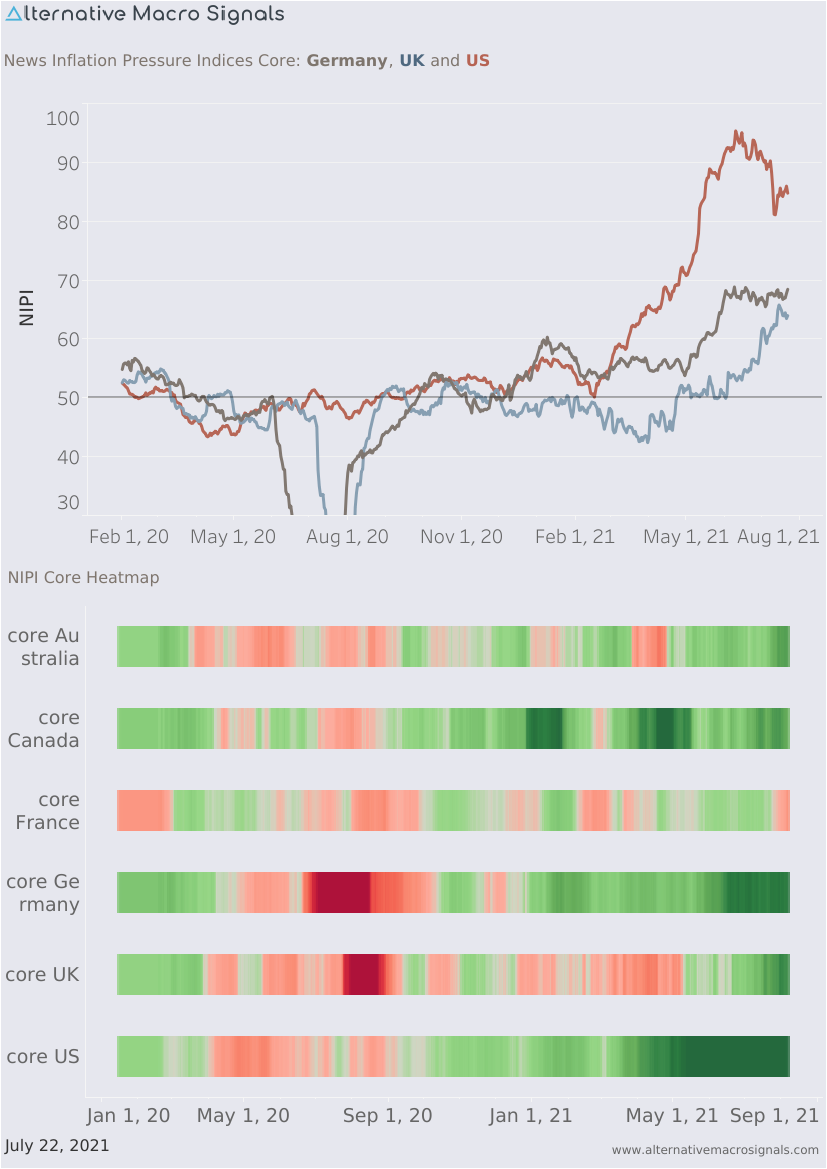

The US economy has been at the forefront, especially since February - March 2021, most likely owing to a more rapid vaccination implementation and reopening of the economy.

The US NIPI is still pretty high. It has eased a bit in the last three weeks or so, as some of the shocks have receded. But at 85 or so, the US core inflation NIPI remains well above the 50 bar which sinals a balanced news flow. It is also still way above other countries. It would be a stretch to talk about a reversal.

Core NIPI

In the last couple of months, the shock broadened to other regions, Europe in particular. The German NIPI rose first. Its level is second only to the US NIPI which should not come as a surprise given the German economy's central place in global trade and the tightness of some its markets. Make no mistake: the inflationary shock is global.

More recently, the UK has joined the move. The core NIPI in particular started to climb around mid-June, for the first time in a long while. The move was subsequently reflected in a strong CPI release. Food pressures are also adding to overall inflation pressures in the UK, with the old supermarket price war headlines from the start of the year being replaced by shortage reports.

Underlying inflation pressures in Canada and Australia are also very strong. France looks like an outlier at the moment, but that's mostly because of a rather poor sales season, a very specific and temporry factor.

Bottom line: the inflation shock should look a little less US specific in the weeks or months to come.

The temporary argument doesn't resist the detailed data analysis. The shock has been building up for three quarters now and keeps broadening, with very few exceptions to date.

This should have implications on central banks monetary policy stance as more communication U-turns are likely to come in H2.

Don't hesitate to reach out for any questions about our work on unstructured macro data.