Our news tracking models have signaled a significant acceleration in US wages, since the start of 2021

Wage increases are very much in the news in the US, with daily reports on minimum wage increases and labour shortages in some sectors.

How can these developments be measured in real time? Official wage data can be frustrating. The best official data often lags by several months if not quarters, while the first batch is often imperfect, prone to revisions in particular.

In short, wage growth seems pretty hard to measure in a timely fashion, even though it is a critical macroeconomic variable.

Enters the News Inflation Pressure Index for wages

Expanding our News Inflation Pressure Indices (NIPI) which track inflation pressures through the news and our News Volume Indices (NVI) which measure the overall volume of inflation-related news, we have built the NIPI-Wages and NVI-Wages to track the directionality and volume of wage news.

Like our price indices, the wage NIPI and NVI rely on hundreds of thousands of potential news sources. They are also based on similar state-of-the-art language models, using supervised machine learning, to analyse whether the news are positive or negative.

Our indices are calculated daily. Our wage indices have been available to AMS clients since November 2020, but this is our first public report. For more methodological details, please see this other post.

Historical pattern

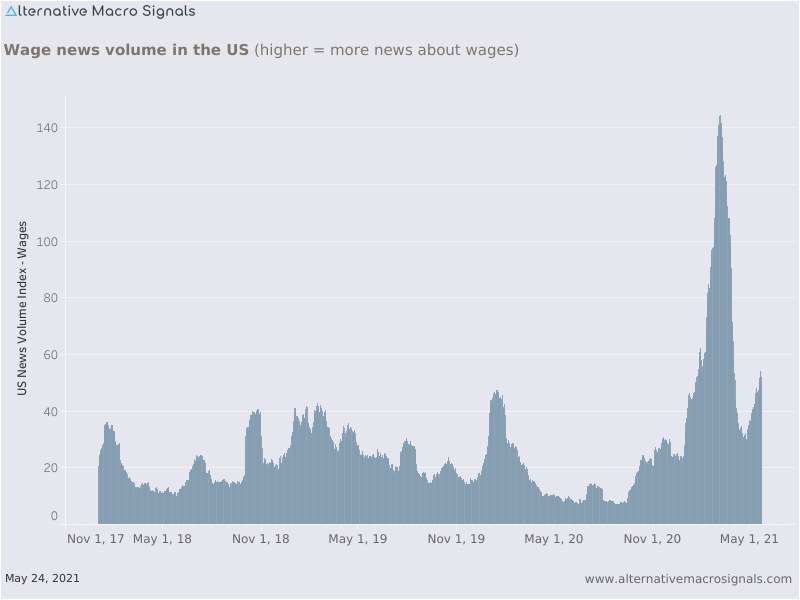

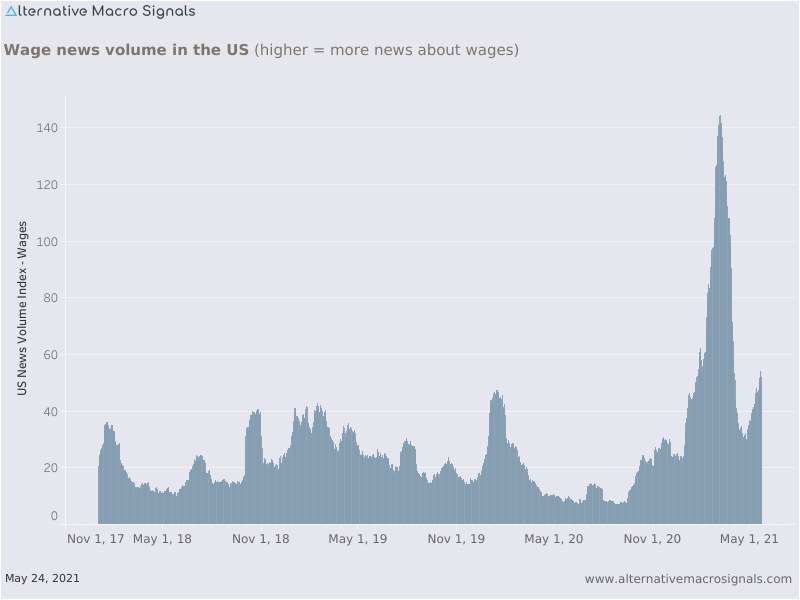

The two charts show the News Inflation Pressure Index for US wages (directionality of the news) and the News Volume Index (total volume of wage news):

Wage news are almost always positive, at least over the covered period since the end of 2017. That's shown by a NIPI-Wages always above the 50 mark, the frontier between positive and negative news.

There has been some seasonality worth noting as the NIPI-Wages has increased markedly in the first quarter of each of the last four years.

In 2020, wage pressures seem to have been muted around the time COVID-19 hit first, but subsequently somewhat recovered ahead of the presidential election.

2021 surge

The most recent data suggest a real regime change:

- the Q1-21 seasonal jump in both metrics is much more pronounced than unusual;

- for instance, the news volume in Q1-21 was more than 3 times that of usual Q1 peaks;

- since March 21, both NIPI-Wages and NVI-Wages have stabilised at a very high level.

This suggests unusual pressure, at least by the standards of the last 3 or 4 years.

Though our sample period is relatively short, it does cover a period where the US economy had been growing strongly and wage pressures were generally seen as building up, ahead of COVID-19. Our data show markedly stronger wage pressures than during this pre-COVID cyclical peak.

We hope this illustrates how unstructured data can offer timely insights into current economic developments.

Note to subscribers: in our database, the NIPI-Wages and NVI-Wages codes for the US economy are 7_US (in the NIPI and NVI databases).